Let's understand what is option max pain theory and how to use it.

Assumption:

- Big Boys (fund houses) have enough funds and resources to move (manipulate) market.

- Big Boys are option seller.

- Around 90% of the options expire worthless, hence option writers/sellers tend to make money more often, more consistently than the option buyers.

Option Max Pain theory:

Options Max Pain Theory suggests, “On option expiration day, the underlying index or stock price often moves toward a point that brings maximum loss to option buyers.”

The maximum underlying option pain is the underlying price point which will cause the maximum loss for option buyers as a whole at the expiration date. It is believed that money-makers are making extra money by selling options (both calls and puts), and they will manipulate the stock price approaching expiration date to minimize their liability to exercise options, causing "maximum option pain" to the option buyers.

Max pain can be calculated manually or automatically using OptionsOracle. Let's see both method below.

Manual process:

If you want to do it manually, here are steps:

- List down the various strikes on the exchange and note down the open interest of both calls and puts for these strikes.

- Now for each of the strike price that you have noted, assume that the market expires at that strike.

- Calculate how much money is lost by option writers (both call option and put option writers) assuming the market expires as per the assumption in step 2.

- Add up the money lost by call and put option writers.

- Identify the strike at which the money lost by option writers is least.

This is the level at which least amount of money is lost by option writers and is the point at which maximum pain is caused to option buyers. Therefore this is the price at which the market is most likely to expire.

Using OptionsOracle

Let's do it using OptionsOracle:

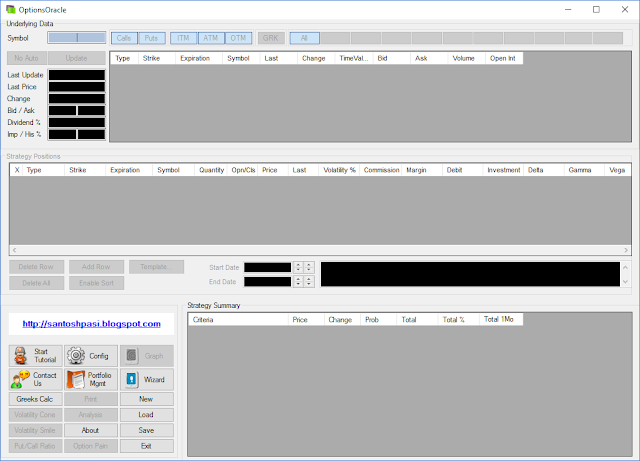

1. Open OptionsOracle, make sure plugin is correctly configured.

2. Now, let's try to find max pain for NIFTY. So in symbol, type NIFTY and click on Update button.

3. Once option chain data is downloaded, click on "Option Pain" button.

4. Finally it will open "Option Pain" graph and if you notice on chart title it does shows Max Pain strike too. If you are using latest version of OptionsOracle (Faster version) then only Max Pain Strike will be shown in title. Earlier version use to show just graph and we have to manually move pointer on graph to identify max pain strike.

The option pain graph shows the total option exercise value at the expiration date. The minimum point of the graph is the buyers "maximum option pain".

As we are nearer to expiry, big boys will try moves (manipulate) an index or stock so that sellers like them will in profit or least hurt whereas option buyer will be at max pain!!!

How to use Max Pain?

Max pain gives you rough estimate where most likely expiry will happen. Using this you may short OTM strikes few ATR or Standard deviation away based on number of days remaining for the expiry on both the sides i.e. OTM CALL and OTM PUT.

Note:

Max Pain strike may change on daily basis.

Trading using max pain may requires adjustments if max pain strike changes.

It is more useful when we are nearer to expiry.

Disclaimer:

Nothing in this article is financial advice and should not be construed as such. Please do not take trading decisions based solely on the matter above; if you do, it is entirely at your own risk without any liability to Pasitechnologies.com.

We may have positions in the market and some of them may support or contradict the material given above.

Well explained. How to use it?

ReplyDeleteThank you Subhashji. I have added section "How to use Max pain?" . Hope this helps.

DeleteLot of knowledge presumed on the part of the readers.

DeleteIt is complex subject. Standard deviation is shown in Graph. Traders using indicators like ATR will be knowing how to use it.

DeleteWe are not getting USDINR options

ReplyDeletePlease let us know how to get them

For USDINR, we use different plugin that is available only to workshop participants and OpStrater users.

DeleteThanks to Mr Pasi post some latest idea about option.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteexcellent progress in your learning santosh

ReplyDelete