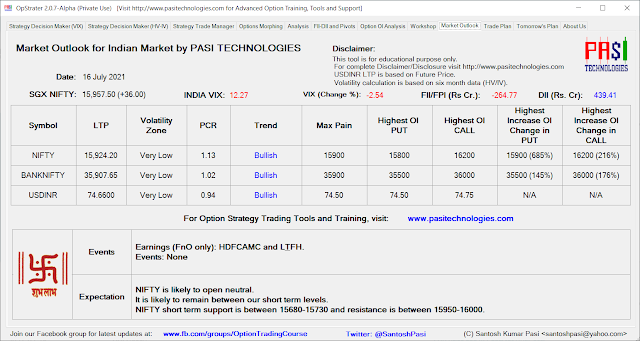

NIFTY is likely to open neutral.

It is likely to remain between our short term levels.

NIFTY short term support is between 15680-15730 and resistance is between 15950-16000.

BANKNIFTY short term support is between 35300-35400 and resistance is between 36200-36300.

Max pain for NIFTY has increased to 15900.

Max pain for BANKNIFTY has increased to 35900.

Max pain for USDINR is same at 74.50.

Can look for Long CALL/Short PUT on drop.

Last Trading Day's Highlights for us:

1. Weekly BANKNIFTY option strategy positional trades: Closed in RED.

2. Monthly Stock option strategy positional trades: Under control.

3. Monthly Stock Covered CALL positional trades: Under control.

4. Monthly NIFTY Covered CALL positional trades: Under control.

Today's Trading Plan:

1. Initiate BANKNIFTY weekly positional trade.

Upcoming Events:

Live Trading Session (Online):

http://www.pasitechnologies.com/p/trading.html

Workshop (Mumbai):

http://www.pasitechnologies.com/p/training.html

Prerequisite:

http://www.pasitechnologies.com/p/prerequisite.html

More info:

1. Moneycontrol Interview:

2. Elearnmarkets Face2Face Interview:

https://www.youtube.com/watch?v=--Ku2hhFL1M

3. Interview:

Trade setup:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.