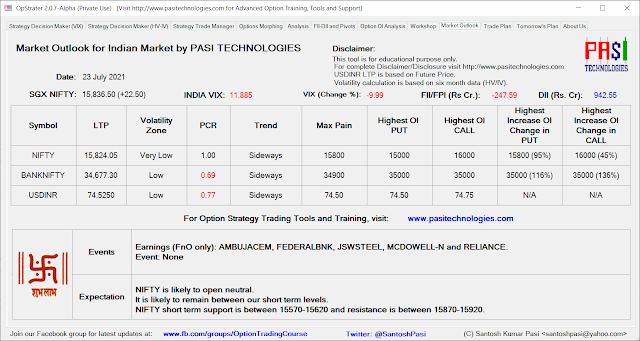

NIFTY is likely to open neutral.

It is likely to remain between our short term levels.

NIFTY short term support is between 15570-15620 and resistance is between 15870-15920.

BANKNIFTY short term support is between 34350-34450 and resistance is between 35270-35370.

Max pain for NIFTY has increased to 15800.

Max pain for BANKNIFTY has increased to 34900.

Max pain for USDINR has decreased to 74.50.

Can look for Long CALL/Short PUT on drop.

Last Trading Day's Highlights for us:

1. Weekly BANKNIFTY option strategy positional trades: None.

2. Monthly Stock option strategy positional trades: Under control.

3. Monthly Stock Covered CALL positional trades: Under control.

4. Monthly NIFTY Covered CALL positional trades: Under control.

Today's Trading Plan:

Initiate BANKNIFTY weekly positional trades.

Reduce risk exposure for monthly positional trades.

Upcoming Events:

Live Trading Session (Online):

http://www.pasitechnologies.com/p/trading.html

Workshop (Mumbai):

Prerequisite:

More info:

1. Moneycontrol Interview:

2. Elearnmarkets Face2Face Interview:

3. Interview:

Trade setup:

https://www.moneycontrol.com/news/business/markets/options-trade-an-earnings-based-non-directional-options-strategy-in-larsen-toubro-7210231.html

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.