Based on volality, Calendar Spread is ideal strategy.

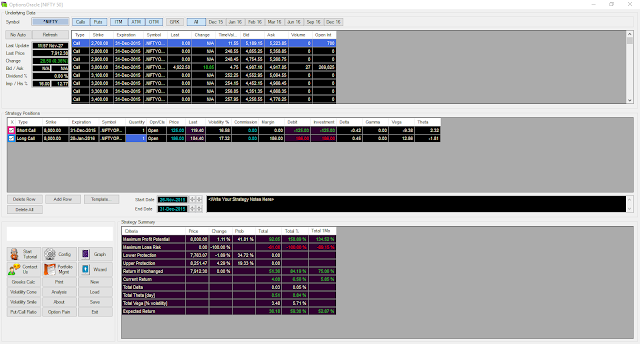

Here is Calendar Spread strategy:

NIFTY DEC15 CE 8000 (S) @ 125

NIFTY JAN15 CE 8000 (L) @ 190

Here is strategy details on our own best and free Options Strategy Analysis tool for Indian market: OptionsOracle

Breakevens (higher side) : 8251

Breakevens (lower side) : 7764Max Loss Potential (in points): -61

Max Profit Potential (in points): 92

Disclaimer:

1. Please use is at your own risk.

2. I'll not be responsible for any risk or damage to your system or data or wealth or health or what so ever.

In case of query, feel free to contact me.

1. Please use is at your own risk.

2. I'll not be responsible for any risk or damage to your system or data or wealth or health or what so ever.

In case of query, feel free to contact me.

Did you exited this position as it is below lower breakeven ? I am still holding the as option we sold will expire worhless and the option bought will get higher value the sensex move back to 8000 level in next expiry. What is your thoughts ?

ReplyDelete@ Sivaas, Not yet exited, Yes you are correct, the one we sold will be worthless if market closes below 8000 on Dec expiry.

DeleteThanks Santhosh

ReplyDeleteIf NIFTY touches 7950 tomorrow, it is good time to book profit.

ReplyDeleteAt expiry, ended this strategy in positive, profit around 45 points.

ReplyDelete