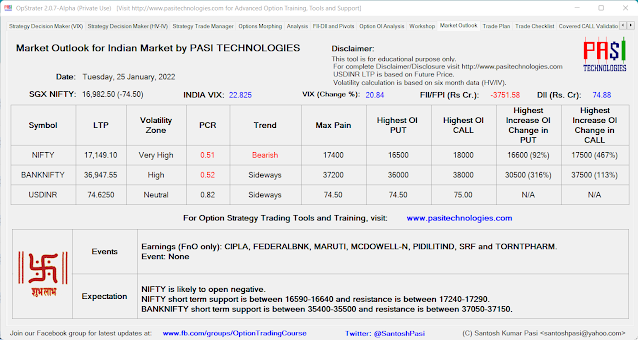

NIFTY is likely to open negative.

NIFTY short term support is between 16590-16640 and resistance is between 17240-17290.

BANKNIFTY short term support is between 35400-35500 and resistance is between 37050-37150.

Max pain for NIFTY has decreased to 17400.

Max pain for BANKNIFTY has decreased to 37200.

Max pain for USDINR is same at 74.50.

Can look for Long PUT/Short CALL on rally.

At our short term levels, directional trades can be tried.

Trade setup:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.