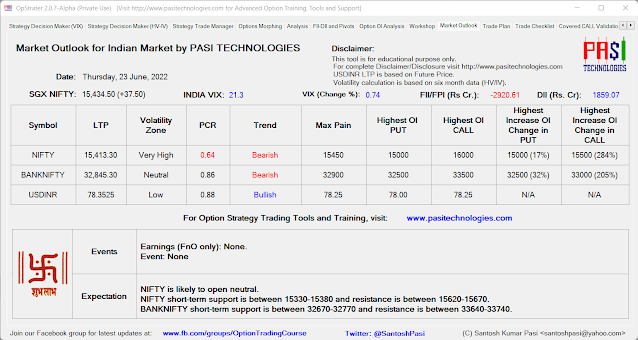

NIFTY is likely to open neutral.

NIFTY short-term support is between 15330-15380 and resistance is between 15620-15670.

BANKNIFTY short-term support is between 32670-32770 and resistance is between 33640-33740.

Max pain for NIFTY has decreased to 15450.

Max pain for BANKNIFTY has decreased to 32900.

Max pain for USDINR has increased to 78.25.

Can look for Long PUT/Short CALL on the rally.

At our short-term levels, directional trades can be tried.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.