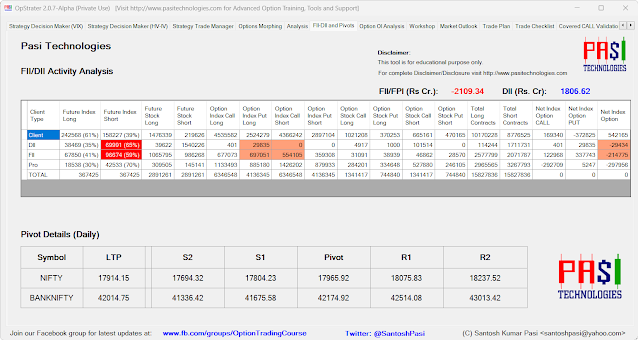

NIFTY is likely to open neutral.

NIFTY short-term support is between 17750-17800 and resistance is between 18300-18350.

BANKNIFTY short-term support is between 41550-41650 and resistance is between 42850-42950.

Max pain for NIFTY has decreased to 17950.

Max pain for BANKNIFTY has decreased to 42200.

Max pain for USDINR has decreased to 82.25.

Can look for Long PUT/Short CALL on the rally.

At our short-term levels, directional trades can be tried.

Disclosure:

Portfolio: NIFTYBeeS, LIQUIDBeeS, HCL TECH, HDFC BANK, ICICI BANK, SBI, etc.

Current stock option trades open: None

We regularly trade BANKNIFTY weekly option.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.