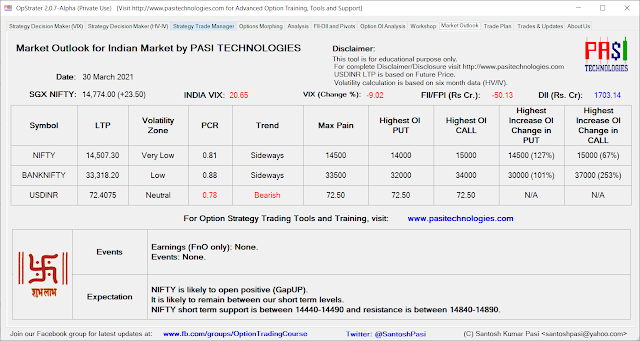

NIFTY is likely to open positive (GapUP).

It is likely to remain between our short term levels.

NIFTY short term support is between 14440-14490 and resistance is between 14840-14890.

BANKNIFTY short term support is between 32400-32500 and resistance is between 34270-34370.

Max pain for NIFTY remains same at 14500.

Max pain for BANKNIFTY remains same at 33500.

Max pain for USDINR has decreased to 72.50.

Can look for Long CALL/Short PUT on drop.

Last Trading Day's Highlights for us:

1. Weekly BANKNIFTY option strategy positional trades: Initiated.

2. Weekly NIFTY option strategy positional trades: None

3. Monthly NIFTY option strategy positional trades: None

4. Monthly Stock option strategy positional trades: None

5. Monthly Currency option strategy positional trades: None

Upcoming Events:

Workshop (Delhi and Mumbai):

Prerequisite:

More info:

1. Moneycontrol Interview:

2. Elearnmarkets Face2Face Interview:

3. Interview:

4. QuantsApp Option Expert Series:

Trade setup:

https://www.moneycontrol.com/news/business/markets/options-trade-a-non-directional-strategy-in-bank-nifty-10-6700491.html

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.