Our Blog Posts

You will find our latest updates, market outlook posts, etc.Testimonials

Feedbacks as provided by participants without editing (so may have typo errors)"I have read quite a lot on options and I can say that only theoretical knowledge might not be fruitful in trading. Santosh did an amazing job of explaining practical concepts and strategies, it was very insightful. "

"Great options workshop basically Non- Directional strategies and Adjustmens. before this workshop I thought option is very difficult to understand but Santonsh sir making it so easy method both learning and working . thanks for beautiful workshop. "

"Workshop is extremely informative and provides insights into fundamentals of option trading thru perfectly designed option trading tools. Easy to understand even for beginners with basic knowledge of options and technical Presentations provided by Mr. Santosh with examples enables ease of understanding of options which otherwise requires in depth understanding of subject. Tools developed by Mr. Santosh are extremely useful for opening a position in market and exiting as per the pre-defined rules. I am sure that this professional approach is sufficient for budding entrepreneurs to start a career or to persons who are into option trading to improve upon their option trading skills to next level. "

"One of my colleague suggested me to attend your workshop and i'm very much satisfied after attending it and it was very good. i was doing blunders in the market before attending it. I'm very much confident and convinced to take small positions. Thank you very much Sir. "

"Enrolled for the workshop to get a understanding of options basic as i had heard a lot about this workshop. Felt the workshop was fantastic and met my goals. Though it's a lot to digest the method of teaching and the strong interactions make the course a breeze. Overall very happy and a satisfied student and enjoyed the 2 days. "

"The Options workshop was beyond my expectation. It was engaging and Santosh was able to keep the whole group interested during the entire workshop on such a complex topic. You need to have intermediate level of knowledge to gain maximum value out of the the workshop. Would strongly recommend to anyone who is serious about Options trading. "

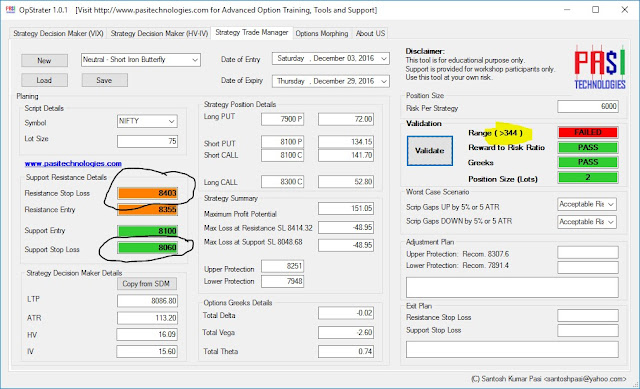

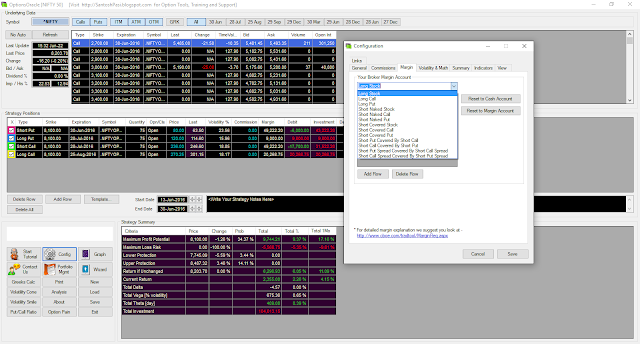

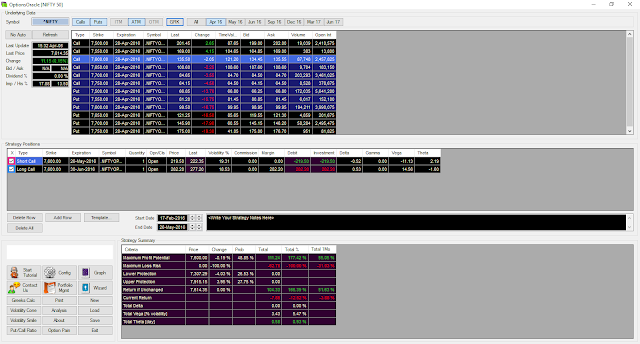

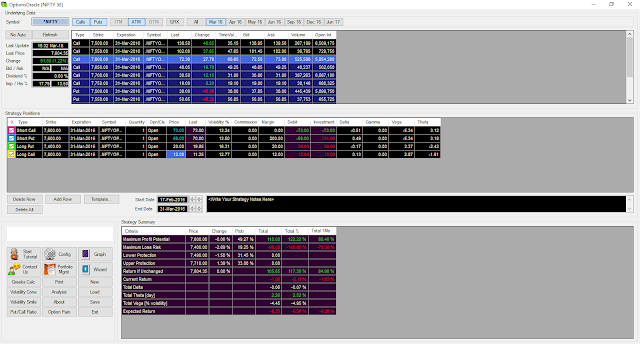

"The literature provided during the training and before training was clear with concepts and easy to understand. The tools offered the option oracle and OpStrater are also simple to use and help identifying option strategy and managing it. The thought process behind choosing different option strategies for different volatility situations was explained very nicely. "

"Workshop was excellent. Strcuture of the course was such that step by step we were moving to higher levels. Everything made sense. Loved the number of filters we used before entering the trade. Also the way non directional strategies were explained it was easy to remember and also link it when studying Bullish / Bearish strategies. "

"It was an eye opening experience. The options is a not an easy topic to understand. But Santosh Sir was too good in explaining the complex subject. Overall it was really a wonderful workshop. It has changed my entire outlook about the market. I hope it will help me a lot in future. I have already recommended this to many friends & relatives. "

"It was excellent Knowledge sharing session. Opportunity to learn so much in 2 days. Santosh makes sure that you understand the concept & then proceeds. The confidence I have got is immense. I take this opportunity to thank Santosh & his efforts. Workshop is Worth every penny. I understood where I was going wrong and will start planning my trades accordingly. "

"This is a very thorough program. Santosh Pasi is a Intelligent Traders and a wonderful teacher. His explains the complicated terms and strategies in Options trading in quite a simple manner with lots of illustrations and live examples. What I like most about the course is all the ideas strategies are logical and very practical. I am confident enough that my Option Trading will better and profitable from here onwards. "

"The literature provided during the training and before training was clear with concepts and easy to understand. The tools offered the option oracle and OpStrater are also simple to use and help identifying option strategy and managing it. The thought process behind choosing different option strategies for different volatility situations was explained very nicely. "

"Training content and trainer both very impactful. Will suit for beginner and experienced both. Best part was the simplicity in training method and participation and engagement with all participants. "

"I HAVE DONE MANY WORKSHOPS SO FAR .But this work shop is the best .Because all the contents related options is in built in this course .MR PASI IS BERY GOOD TRAINER .He is the only guy who I found making his participents practice options during workshops.He could finish workshop in at 6 PM.But he goes nonstop till 9PM.Kya energy hai "

Get in Touch

Feel free to drop us a line to contact usFeel free To Contact

Although we have tried our best to provide details onlines, still if you have some queries, feel free to contact us.

- +91 98202 00550

- santoshpasi@yahoo.com

- www.pasitechnologies.com

- https://twitter.com/SantoshPasi