Here is trade idea based on tool "Strategy Decision Maker". It recommended strategy "Calendar Spread".

If you are not sure what is "Calendar Spread" or other options strategies, you can join my Options Trading workshop

Here is strategy:

NIFTY MAY16 CE 7600 (S) @ 222

NIFTY JUN16 CE 7600 (L) @ 277

NIFTY JUN16 CE 7600 (L) @ 277

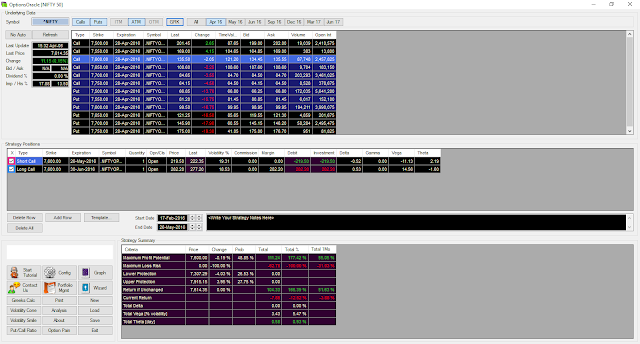

Here is strategy details on our own best and free Options Strategy Analysis tool for Indian market: OptionsOracle

Profit Loss Graph on Options Strategy Analysis Tool OptionsOracle:

Breakevens (lower side) : 7307

Breakevens (higher side) : 7915

Max Loss Potential (in points): -63

Max Loss Potential (in points): -63

Max Profit Potential (in points): 111

Risk Reward ratio is just 1:1.7

Note before you take trade:

- You should be comfortable with maximum loss mentioned above.

- If you are new to Option trading or doesn't know how to adjust trade or greeks, close all positions as soon as your positions shows profit near 1/3rd of maximum profit potential.

- Excel based tools "Strategy Decision Maker" and "Strategy Trade Manager" is exclusively available to participants who takes my course in "Options Trading".

Disclaimer:

- You can take similar trade in a day or two, provided you get same or higher Risk Reward Ratio, and other greek remains same.

- Please use is at your own risk.

- I'll not be responsible for any risk or damage to your system or data or wealth or health or what so ever.

In case of query, feel free to contact me.

Thank you Blogger for this blog.

ReplyDeleteThis blog is very beneficial for the stock market trader.

CapitalHeight Investment Adviser

ReplyDeleteThank you for sharing this information and Very good looking blog on

minimum brokerage