Iron-Butterfly

This strategy is to take benefit of theta, this weekend and long weekends next week.

Here is strategy:

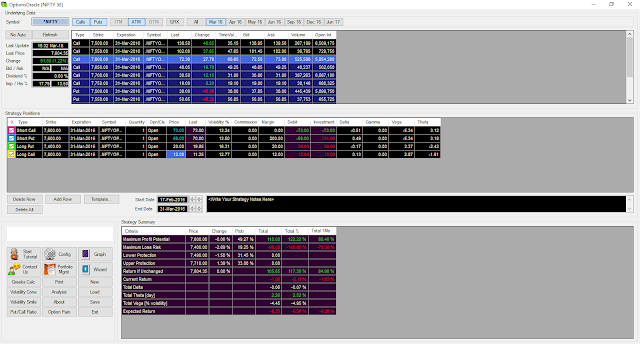

NIFTY MAR16 CE 7800 (L) @ 12

NIFTY MAR16 CE 7600 (S) @ 73

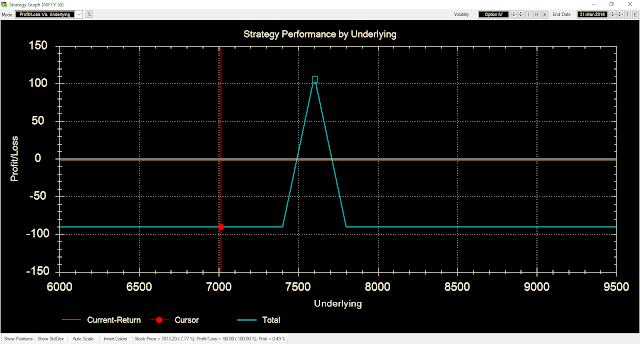

Max Loss Potential (in points): -90

This strategy is to take benefit of theta, this weekend and long weekends next week.

Here is strategy:

NIFTY MAR16 CE 7800 (L) @ 12

NIFTY MAR16 CE 7600 (S) @ 73

NIFTY MAR16 PE 7600 (S) @ 69

NIFTY MAR16 PE 7400 (L) @ 20

NIFTY MAR16 PE 7400 (L) @ 20

Here is strategy details on our own best and free Options Strategy Analysis tool for Indian market: OptionsOracle

Breakevens (lower side) : 7490

Breakevens (higher side) : 7710

Max Profit Potential (in points): 110

Note Risk Reward ratio is just 1:1.2, it may require adjustment. If NIFTY touches either 7450 or 7750, we will square-off body of IB (i.e both CE and PE 7600). Only wings of IB (i.e. PE 7800 and CE 7400) will be left.

For Advanced Options Strategy Trading Course (NIFTY, BankNIFTY, NSE Stocks), check Training -> Option Trading. It's 2 days workshop.

Disclaimer:

- Please use is at your own risk.

- You can take similar trade in a day or two, provided you get same or higher Risk Reward Ratio, and other greek remains same.

- I'll not be responsible for any risk or damage to your system or data or wealth or health or what so ever.

- In case of query, feel free to contact me.

We ended this trade in loss of around 29 points.

ReplyDeleteAmazing article!! helps us in making better investing strategy in trade market. so thank you for this nice blog and plese continue sharing your ideas.

ReplyDeleteoptions trading